Zip Co said its all-scrip acquisition of Sezzle will help it achieve faster profitability, pledging to get to positive cash earnings by the 2024 financial year as a larger user base makes the payments platform more attractive to US retailers.

Zip is raising $200 million via a placement and share purchase plan to drive growth on the back of the acquisition of United States-focused Sezzle, as the buy now, pay later industry races to get to scale and reduce bloated costs.

The deal values Sezzle at $491 million, according to Zip, a 22 per cent premium to spot prices of its ASX-listed shares, which remained in a trading halt on Monday. Investors have been pushing for loss-making technology companies to focus more on profits and show disciplined use of capital, given interest rates are set to rise.

The transaction, due to be completed in the July quarter, has been unanimously approved by the boards of both companies.

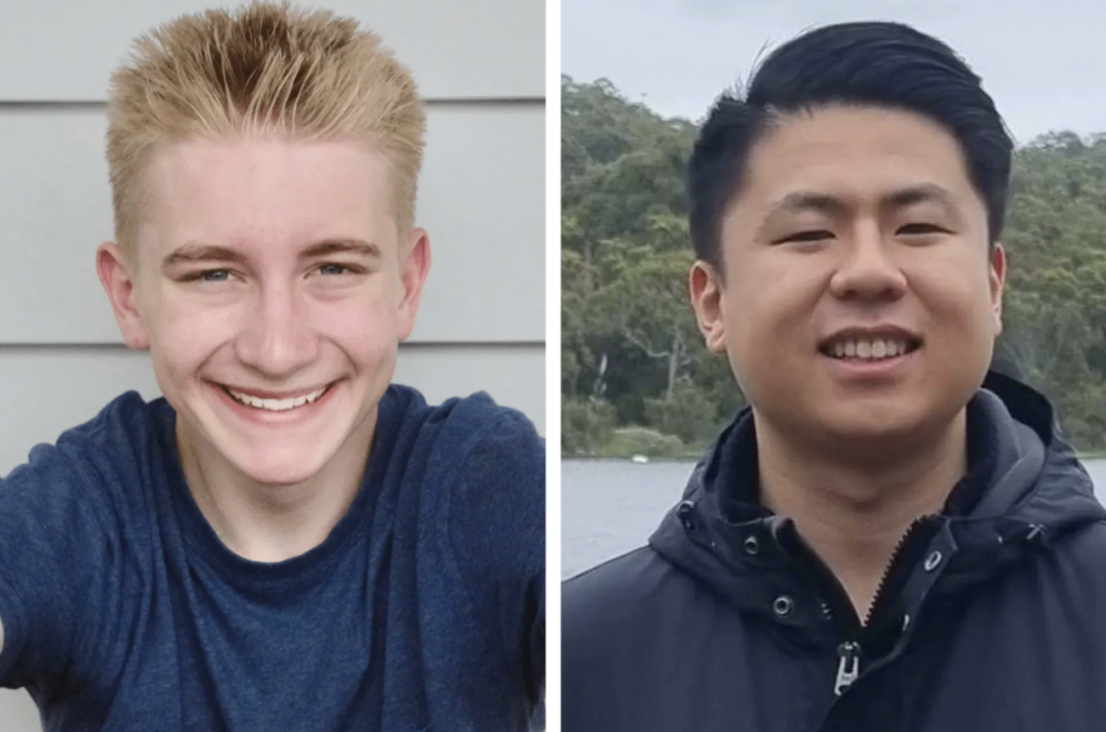

“We have taken stock of what is happening in the world around us and capital markets, so it was important to put in place a target to achieve sustainable growth much faster than we had originally forecast,” Zip co-founder Larry Diamond told The Australian Financial Review.

“We were already thinking about that and this transaction helps us sharpen our thinking and simplify the investor story as well.”

The combined business will have more than 13 million customers (Zip’s 10 million plus Sezzle’s 3.4 million); and 129,000 merchants (Zip’s 82,000 plus Sezzle’s 47,000).

Sezzle will be rebranded as Zip, which also took over the Quadpay brand in the US after buying it in 2020. Zip will become more focused on the US overall, with 60 per cent of sales to be generated there, up from 48 per cent now.

Zip expects $130 million of synergies from the deal as overlapping costs are eliminated, and for top-line growth to continue. Mr Diamond said buy now, pay later is expected to see the strongest growth of any payment method in the US, from a low base of 2 per cent.

In the US, Zip’s customer app is superior to Sezzle’s but Sezzle has been stronger in merchant relationships at the checkout.

Analysts said in the medium term, a larger Zip would be more attractive to financial institutions looking to acquire BNPL after its larger rival Afterpay was scooped up by Block, formerly Square.

“I think the deal makes a lot of sense, especially for Sezzle, which is too small and probably wouldn’t have survived on its own,” said analyst Marc Kennis from Stocks Down Under.

“The new combination probably puts Zip/Sezzle more prominently on the radar screens of large financial institutions ... An acquisition of Zip with Sezzle is still the likely end game for the company, in my view. In the US, the new combo is probably the most attractive independent player right now.”

However, one banker said the deal points to panic in the buy now, pay later sector, with shares in Zip and some smaller operators down around 80 per cent from peak levels. “Zip placing stock at a discount and buying a sub-scale business at a premium?” he said. “The banker in me struggles to remember a deal that smacks of more desperation, and where putting two failed strategies together makes a successful one.”

Stronger balance sheet

Zip will look to list its shares on a US exchange as part of the deal, opening up fresh capital-raising options. Its ASX stock is one of the most highly traded stocks among retail investors.

The $150 million placement and accompanying $50 million share purchase plan was first reported in The Australian Financial Review’s Street Talk column on Sunday evening. Zip will issue 78.3 million new shares, equal to 13.3 per cent of its current shares on issue. Street Talk reported on Monday morning the shares will be placed for $1.90 each, a 14 per cent discount to the last close.

Sezzle founder Charlie Youakim will join Zip as head of Americas and as an executive director of its board. Sezzle has relationships with several large US merchants not on Zip’s books, including Ikea, Target and Shopify.

Zip said the merger would take place under the laws of the US state of Delaware. Shareholders in Sezzle, whose shares jumped 14 per cent on Friday, will receive 0.98 Zip shares for each Sezzle share they own. When completed, Zip shareholders would own around 78 per cent of the combined group while Sezzle shareholders would own the remaining 22 per cent.

“With Sezzle, we are doubling down in the US, and believe we have what it takes to win in that core market,” Mr Diamond said on the investor call.

The deal comes as Zip released delayed interim results showing a deepening loss and bad debts. Last week it pre-reported a cash EBTDA loss for the first half of $108 million, much deeper than analysts had expected. It’s adjusted loss before tax was $153.6 million.

Zip pledged the acquisition of Sezzle would help it reach positive EBTDA by the 2024 financial year, although analysts said more detail is needed to get confidence it can hit the target.

“Achievement of [free cash flow] break-even will require a combination of higher volumes, which will require Zip to grow its loan book, and right-sizing of its current cost base, in addition to revenue and cost synergy targets being achieved,” said UBS analyst Tom Beadle.

Improving credit quality

Zip revealed net bad debts had risen to 2.6 per cent of sales, an increase of 132 basis points on 2021 levels. Bad debts plus expected credit losses rose 402 per cent to $148.3 million, representing 3.3 per cent of sales. Marketing expenses rose by 182 per cent to $74.5 million.

Zip co-founder Peter Gray said close attention is being given to improving credit quality to reduce losses to the target of 2 per cent of sales. He added it is well able to withstand rising cash rates; a 25 basis point increase in base rates will increase funding costs for a “pay in four” transaction by 2 basis points, he said.

“We are committed to our global expansion plans but are taking a more disciplined approach,” Mr Gray said.

Strong transaction growth continues: Zip reported record sales volumes of $4.5 billion through its platform over the first half, up 93 per cent, and around half the value that is going through Afterpay. Revenue is also at record levels, up 89 per cent at $302 million for the half.

Zip’s total customers grew to 9.9 million, up 74 per cent compared with the end of the previous first half; its merchant numbers grew 113 per cent to 81,800.

Path to profitability

The focus on creating a path to profitability comes as Zip’s share price suffered a horror run, falling 30 per cent in the past month as investors worried about deteriorating unit economics, although it rose sharply at the end of last week.

While Zip pointed to record volumes it said higher than expected bad debts had squeezed the “cash transaction margin” to 2.1 per cent, down from 3 per cent in the second half of last year. Zip said it would lift this margin when the merger is complete to target higher than 2.5 per cent over the medium term.

The acquisition of Sezzle comes amid a wave of industry consolidation. Afterpay’s co-founders Nick Molnar and Anthony Eisen sold to Block, which will use BNPL as part of a broader range of services in a financial super app. Meanwhile, Humm, a sub-scale operator, is being acquired by Latitude.

Zip has already been scooping up BNPL investments, including Quadpay, a transformative deal to grow in the US market, struck in the middle of 2020.

Like Block’s Cash App, Zip also aspires to create a multipurpose digital wallet for users that provides banking and investment options as well as BNPL products. Late last year it formed a partnership with WebBank and will compete more directly with US neobanks.

Some have a dim view of Zip’s ability to win in the US, even with Sezzle. “Zip buying Sezzle is basically the Titanic buying the Hindenburg,” consultant Brad Kelly said on social media last week.

But Mr Gray said bad debts will not deter it from releasing new products in the US. “Despite the current credit conditions affecting this jurisdiction, the growth trajectory continues, and the US continues to present growth opportunities, given low BNPL penetration levels,” he said.