- Since the start of the pandemic, e-commerce has exploded globally, radically transforming shipping and supply chains.

- It’s part of the avalanche of factors behind current supply chain chaos.

- “There’s a huge amount of money which consumers are reallocating to consumer goods,” said Leigh Williams, founder and managing director at eStore Logistics.

Australians started buying stuff at the start of the pandemic — and never stopped.

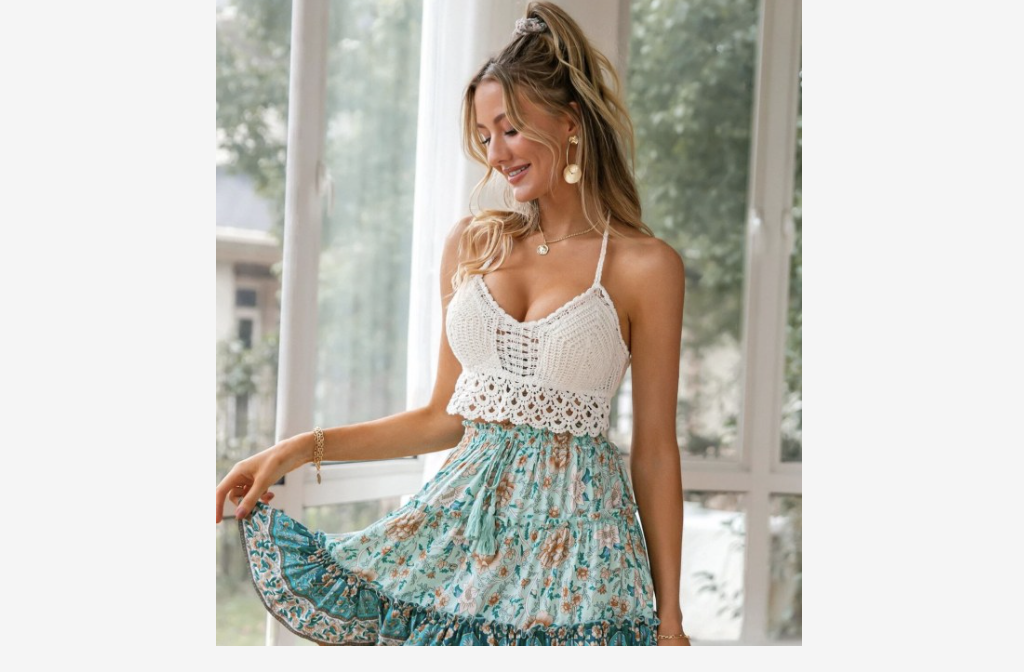

The explosion of e-commerce globally as a result of lockdowns has led to a radical transformation in consumer behaviour.

In Australia, online shopping surged 57% year-on-year in 2020, according to Australia Post’s Online Shopping report published in March of this year.

Australians spent an astounding $50.46 billion online over that year, up from $32.1 billion in 2019.

And the number of companies taking business online each month more than doubled from pre-pandemic levels, peaking in July 2020, according to research conducted by Mastercard around its Australian activity.

As a result, the logistics sector is experiencing a level of demand unlike anything it’s seen before.

Jackson Meyer, CEO of Australian freight forwarding company Verus Global, said he’s never seen so much activity in his industry.

“The demand has been immense,” he said.

Meyer said that while the sector saw a surge in activity during the first lockdowns in March of 2020, he didn’t expect it would continue into this year.

“Everyone sort of presumed that the demand would somewhat subside, because demand was so immense at the start,” he said. “But with [another] lockdown…people have got more money to spend.”

Leigh Williams, founder and managing director at eStore Logistics, told Business Insider Australia its research showed around $60 billion worth of travel spending had been diverted into online shopping in the past 18 months.

The company, a third-party logistics provider, offers warehousing and order fulfilment services to e-commerce and retail businesses.

“There’s a huge amount of money which consumers are reallocating to consumer goods,” Williams said of the explosion of online spending that had seen his company record a 94% year-on-year increase in orders on its platform in April of 2020.

Since then, e-commerce acceleration has not slowed down; in April 2021 there was still an 80% increase in online orders compared to 2019.

“What we’ve seen is homewares, electronics… all of their volumes significantly increase because consumers are stuck at home with really not much else to do, other than furnish their home or buy stuff for their home offices or to buy things which entertain them,” Williams said.

A glut of explainers and analysis have arisen to help people across the Western world reckon with a new reality that has disrupted the smooth conveyance of goods from a pixelated image to physical item on their doorstep.

A brief rundown starts in China, where a bulk of consumer goods are manufactured — and where pandemic lockdowns first disrupted the supply chain by keeping workers at home and away from ports. From here, the cost of containers skyrocketed, pushed up by the difficulty of getting them filled and in and out of ports. Adding to this, ships began skipping stops at ports altogether because of congestion caused by delays in moving containers out.

The flow-on effect has been that “we’re seeing Australia being impacted more than what Europe and the US is,” Meyer said.

Australia has imported an immense amount of products in the past year, and it is part of the avalanche of factors behind current supply chain issues.

According to ABS data, the country’s inventory to sales ratio plummeted in late 2020 and early 2021.

This metric, which compares how much sellers have on hand to how much consumers are buying, points to significant shortages brought about by the pandemic.

COVID-19 has exacerbated this, causing a global mismatch in the supply and demand of containers.

Australia is reporting a pile up of empty shipping containers at its ports, leading to “excessive truck queuing delays, and inefficient movement and handling processes,” according to Freight Australia.

Adding to this are rolling strikes in the past month in ports across Sydney and Melbourne that have massively reduced headcount.

The culmination of the demand for imports is congestion that is “creating a series of issues,” Meyer said, that are “getting even worse”.

“We’re having circumstances whereby shipping lines are actually suspending services; so the whole vessel itself is skipping ports,” he said.

Some companies have stopped importing to Australia because of skyrocketing e-commerce costs

Because of the massive amount of volume coming out of Asia — and the backlog there — there’s a shortage in vessel availability for goods to be sent from China to Australia. This is causing delays for products to be put on ships and actually sent to Australia.

Meyer said this “increased backlog” has meant his company’s clients “can’t get the stuff we expected to get”.

“We’re seeing cancelled bookings, cancelled slots, cancelled containers because of this,” Meyer said.

Another issue is an explosion in the cost of e-commerce imports, which has had the two-pronged effect of both pushing up prices locally, and leading importers to choose to delay bringing their goods into the country.

“Eighteen months ago, businesses would pay about $1,500 to ship a container from China to Sydney or Melbourne,” Williams said. “And now it’s like $10,000.

“So there’s very short supply, there’s huge demand, the costs are going up.”

Meyer said because the cost of containers is so high, often the commercial value of what’s inside is actually less than what the business is paying for shipping.

“We’ve seen a series of customers, particularly the ones importing lower cost items like packaging and paper products, they’re opting for waiting it out,” Meyer said.

Retailers risk passing on higher costs to consumers

Soaring shipping costs now risk being passed on to consumers, according to a report into the container crisis released on November 5 by the ACCC.

Some retailers have already signalled this is the most likely outcome.

ASX-listed furniture retailer Nick Scali’s chief executive Anthony Scali in late October said disruptions caused in part by lockdowns in its supply hub in Vietnam meant it would be forced to push through price rises of as much as 10%.

Williams said another possibility was that once lockdowns ended, while consumption would diminish, online consumption behaviours would continue.

“I think we’ll find e-commerce penetration to be a lot further ahead of what it was pre-pandemic, and a lot further and where it was forecast to be by the start of 2022,” he said.