Amazon plans to lay off approximately 10,000 people in corporate and technology jobs starting as soon as this week, people with knowledge of the matter said, in what would be the largest job cuts in the company’s history.

The cuts will focus on Amazon’s devices organisation, including the voice-assistant Alexa, as well as at its retail division and in human resources, said the people, who spoke on condition of anonymity because they were not authorised to speak publicly.

The total number of layoffs remains fluid. But if it stays around 10,000, that would represent roughly 3 per cent of Amazon’s corporate employees and less than 1 per cent of its global workforce of more than 1.5 million, which is primarily composed of hourly workers.

Amazon’s planned retrenchment during the critical holiday shopping season – when the company typically has valued stability – shows how quickly the souring global economy has put pressure on it to trim businesses that have been overstaffed or under delivering for years.

Amazon would also become the latest technology company to lay off workers, which only recently it had been fighting to retain. This year, the e-commerce giant more than doubled the cap on cash compensation for its tech workers, citing “a particularly competitive labour market”.

Changing business models and the precarious economy have set off layoffs across the tech industry.

Tech sector layoffs

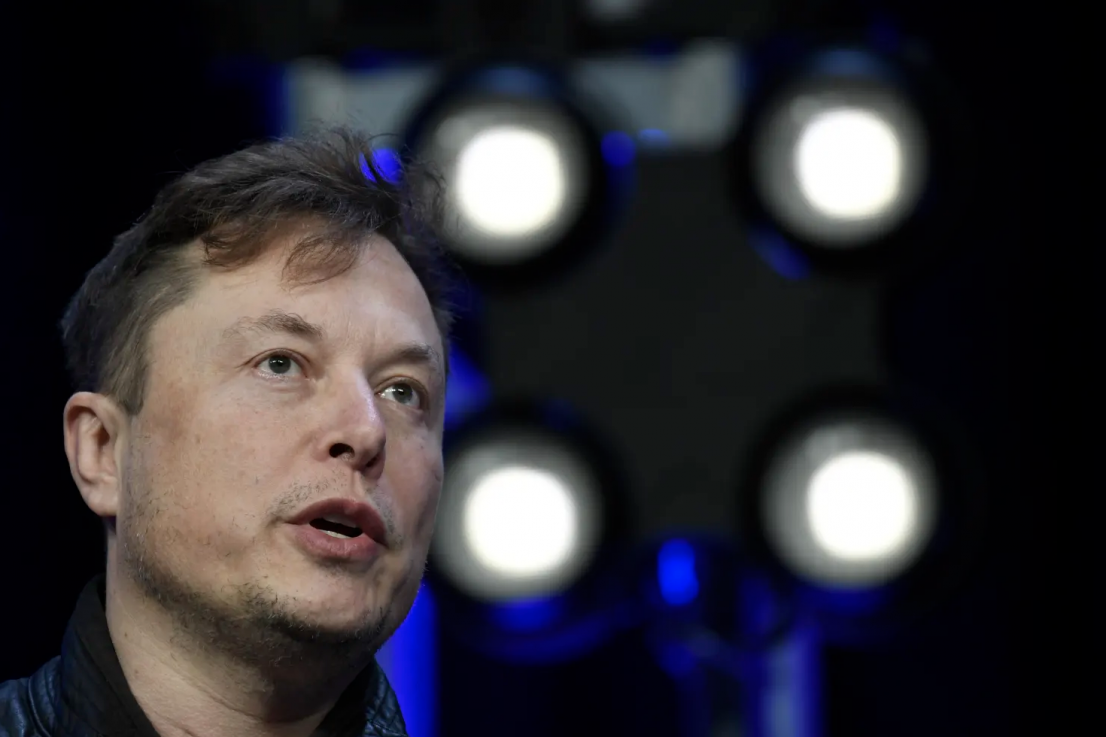

Elon Musk halved Twitter’s head count this month after buying the company, and last week Meta, the parent company of Facebook and Instagram, announced it was laying off 11,000 employees, about 13 per cent of its workforce. Lyft, Stripe, Snap and other tech firms have also laid off workers in recent months.

Brad Glasser, an Amazon spokesperson, declined to comment.

The pandemic produced Amazon’s most profitable era on record, as consumers flocked to online shopping and companies to its cloud computing services. Amazon doubled its workforce in two years, and funnelled its winnings into expansion and experimentation to find the next big things.

But earlier this year, Amazon’s growth slowed to the lowest rate in two decades, as the bullwhip of the pandemic snapped. The company faced high costs from decisions to overinvest and rapidly expand, while changes in shopping habits and high inflation dented sales.

Amazon experienced a slight rebound in its latest quarter. But it has cautioned investors that growth could weaken again, possibly falling to its lowest pace since 2001.

The company has told Wall Street that it has tightened its belt in the past and can do so again. Last week, Amazon executives met with institutional investors, according to three people, just as its stock sank to its lowest level since the early days of the pandemic, erasing $US1 trillion ($1.5 trillion) in value since Andy Jassy took over as CEO last year.

Trimming costs

Mr Jassy, who previously ran Amazon’s lucrative cloud computing business, has been closely scrutinising businesses to trim costs quickly. He initially pulled back on a warehouse expansion that was supercharged during the pandemic, then moved to other parts of the company.

In recent months, Amazon has also closed or pared back a smattering of initiatives, including Amazon Care, its service providing primary and urgent health care that failed to find enough customers; Scout, the cooler-size home delivery robot, that employed 400 people, according to Bloomberg; and Fabric.com, a subsidiary that sold sewing supplies for three decades.

From April through September, it reduced head count by almost 80,000 people, primarily shrinking its hourly staff through high attrition.

Amazon froze hiring in several smaller teams in September. In October, it stopped filling more than 10,000 open roles in its core retail business. Two weeks ago, it froze corporate hiring across the company, including its cloud computing division, for the next few months.

That news came so suddenly that recruiters did not receive talking points for job candidates until almost a week later, according to a copy of the talking points seen by The New York Times.

Echo, Alexa restraint

Devices and Alexa have long been seen internally as at risk for cuts. Alexa and related devices rocketed to a top company priority as Amazon raced to create the leading voice assistant, which leaders thought could succeed mobile phones as the next essential consumer interface.

From 2017 to 2018, Amazon doubled staff on Alexa and Echo devices to 10,000 engineers. At one point, any engineer getting a job offer for other Amazon roles was supposed to also get an offer from Alexa.

The company has sold hundreds of millions of Alexa-enabled devices. But Amazon has said the products are often low margin and other potential revenue sources such as voice shopping have not caught on.

In 2018, Echo and Alexa lost about $US5 billion, said a person with knowledge of the finances. When Amazon introduced new devices this fall in an annual event, it was notably more restrained than past years when it had featured zany products such as a sticky note printer and $US1000 home robot.