Myer and David Jones aren't the only companies chary of Amazon Australia's move into the $2.4 billion premium beauty market.

Global beauty companies Chanel and L'Oreal – which owns Lancome, Giorgio Armani, YSL, Shu Uemera, Kiehl's and Urban Decay – are fuming after Amazon started to sell luxury beauty products on its Australian site this month.

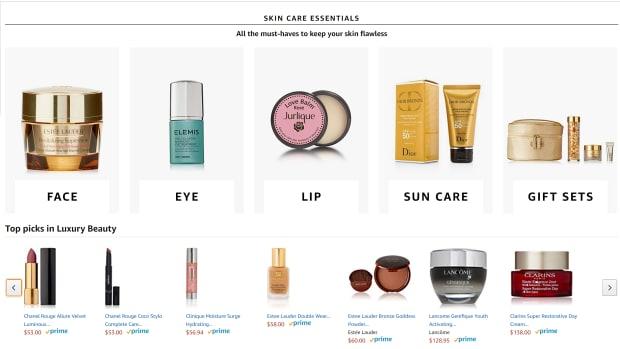

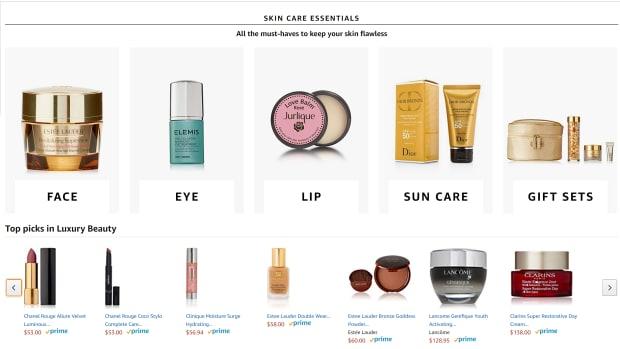

Chanel and L'Oreal do not sell their luxury brands on Amazon.com.au and were caught by surprise when Amazon announced it would add 200 luxury beauty and salon brands including Chanel, Clinique, Elizabeth Arden, Estee Lauder and Jurlique to its existing beauty range.

Industry sources say the Chanel and L'Oreal brands are being sourced by Amazon.com.au through the grey market and sold by unauthorised third-party sellers such as Cosmetics Now Australia, Strawberrynet, The Fresh Group, Price Rite Mart and The Makeup Stop.

"We do not supply Amazon – it's all grey-market product," one source said. "Selling grey–market product is not putting your consumer first."

A grey market refers to the trade of a product through distribution channels that are legal but unintended by the manufacturer or brand owner.

As a result, prices on Amazon.com.au vary wildly from those in authorised channels such as Myer and David Jones, Sephora, Mecca and Adore Beauty and the brands' official online stores. Stock availability is also very low, down to one or two units in many cases.

For example, Kiehl's ultra-facial oil-free gel costs $44 on the official Kiehl's website and in David Jones and Myer, but is listed at $57.75 by third-party sellers on Amazon.com.au.

Chanel's rouge allure luminous intense lipstick costs $72.24 on Amazon.com.au, with only one unit now in stock. It costs $53 in Myer, David Jones and through online retailer Adore Beauty.

Lancome's Hypnose perfume (75ml) costs $129.05 on Amazon, with four units in stock, but is $189 in Myer and $189 on the official Lancome site.

Beauty companies fear irrational pricing, low stock availability and potential quality issues – particularly if stock is counterfeit, out of date or has been stored incorrectly – could damage consumer perceptions of their brands.

The irrational pricing also threatens to deter Amazon shoppers. According to eBay research, competitive pricing is the most important criteria for online shoppers, ranking ahead of free shipping and wide selection.

Brand integrity

Chanel is particularly aggrieved because Amazon's move undermines global efforts to protect the integrity of its brand and control grey-market product, which represents less than 1 per cent of sales. Chanel declined to comment on Thursday.

A L'Oreal spokeswoman confirmed the company was "not a partner" to Amazon for luxury beauty products and the only luxe product it sold on Amazon was Clarisonic facial cleansing kits.

Asked whether Amazon Australia was selling stock sourced from the grey market, a spokeswoman said distribution agreements were between a brand and its distributors.

"Amazon’s customers deserve access to the widest selection of authentic goods at competitive prices, and we welcome the opportunity to provide authentic products that are directly or indirectly sourced," the spokeswoman said. "Amazon is always innovating on behalf of customers and we put our energy into ensuring they find low prices every day."

Amazon.com.au appears to be taking advantage of the fact Chanel does not sell products through multi-brand online beauty sites such as Mecca, Sephora and Adore Beauty and does not have its own e-commerce site in Australia. Rather, it relies on stand-alone Chanel boutiques and partners such as Myer and David Jones.

L'Oreal Australia began selling Kiehl's, Giorgio Armani, Lancome and YSL direct to consumers through single-brand online sites last year and is considering launching a multi-brand site. It also sells some brands through Sephora, Mecca and Adore.

Majors reluctant

Online beauty sales are growing 25 per cent a year– more than three times faster than in bricks-and-mortar stores – and account for 21 per cent of the Australian market, up from less than 5 per cent 10 years ago.

In the US, Amazon has tried to convince luxury beauty brands to come to the party by enabling brands to have their products “gated” or protected from being sold by third parties.

While Amazon is now a popular route to market for independent, start-up and mass-market brands such as Maybelline (owned by L'Oreal), and Covergirl, the major luxury brands are reluctant to take the plunge.

According to a Coresight Research report last month, Amazon is the US' second most-popular beauty product retailer after Walmart. But it remains heavily reliant on third-party sellers, who account for 92.4 per cent of beauty products listed and 94.5 per cent of make-up listings.

Clinique, which is owned by Estee Lauder, is one of the three top-selling brands on Amazon in the US, according to the Coresight report. But, like L'Oreal and Chanel, Clinique does not sell to Amazon.

"Estée Lauder Companies do not have a distribution agreement in place with Amazon," a spokeswoman said.

"These products have not been sourced via authorised channels and we therefore cannot guarantee the authenticity, shelf life or shipping and storage conditions of the products."