- Kmart ‘hack’ pages and influencers devoted to the Australian department store brand have become a major force online, helping to rehabilitate the brand’s image and bottom line.

- But Kmart does not financially remunerate the creators who promote its products, even though influencers can command sizable fees when working with brands.

- Leaders in the “die hard” community say they are treated fairly by Kmart, but experts say there is a grey area between online fandom and unpaid promotion.

- Visit Business Insider Australia’s homepage for more stories.

“At the moment, I’m standing in my front little hallway… bit,” Helen James says, her eyes roaming around the room. “So when you walk in my front door, this is what you see.”

Behind her is a low-lying shelf, which holds a simple, modern lamp and a candle. A framed photo peeks from below. A print hangs on the wall. It’s styled like a mid-century travel poster, but instead of Paris or Marrakech it advertises the golden sands of Frankston, a suburb on Melbourne’s southern outskirts. It is, by all accounts, a clean, neat corner of a modern Australian home.

“It’s a little bit of a hot mess at the moment, not much there,” James says.

“But Kmart has kindly, kindly sent me their new Egon sideboard. It’s $49, and I’m going to style it with some Kmart pieces, and hopefully dress up my little area, so it’s nice and inviting when you walk in the door.”

‘Inviting’ is the right word. James is speaking through her Instagram account, @i_heart_kmart, where she has welcomed 121,000 followers into her home, closet, and kitchen, each styled and supplied with goods from Australian department store Kmart. It is here where a suburban entryway becomes a hub for countless self-professed Kmart fans to congregate.

Her visitors approve of the new look. They comment on each element replaced by something a bit newer, a little fresher.

“Love this space,” one follower writes. “Do you mind letting me know what the back of the unit looks like?” comments another. “Do you think it could be a floating piece?”

James is a star in a constellation of content creators, acolytes, and thrifty shoppers who form the Kmart fan community. It’s a massive, influential, and under-researched group, whose online ranks have grown with the company’s resurgence in the last decade.

A brand renewal

There have been plenty of stories about Kmart’s miraculous turnaround, and how parent company Wesfarmers and former CEO Guy Russo made the brand profitable. Less has been said about its online fanbase, who somehow made Kmart — a dowdy discount department store — into something legitimately desirable.

Kmart certainly recognises the community’s value. James received her new sideboard through the brand’s “gifted for review” program, part of Kmart’s effort to involve the community’s biggest stars in its own marketing campaigns. Key figures are regularly invited to seasonal events and product launches.

But Kmart does not financially compensate the influencers who drive its online fandom. And company staff appear to control at least one major ‘hack’ group on Facebook, indicating that the brand plays a quiet but active role in seemingly ‘organic’ communities.

James, and the other influencers Business Insider Australia spoke to, say they are ecstatic to work with a brand they genuinely love.

But a question remains: in the modern influencer economy, should an online community, whose tastes help dictate the success of a billion-dollar company, ask for more than a free sideboard in return?

The heavily abridged story of Kmart Australia goes like this: After opening its first store in Burwood, Victoria in 1969, Kmart expanded to become a mainstay of Australia’s department store scene. Nestled between the upmarket Myer and David Jones, and cheaper two dollar store offerings, Kmart offered Australian households access to affordable essentials, selling microwaves, mugs, trackpants, and paperbacks by the pallet.

But the brand’s fortunes decreased as its range ballooned in size. By 2008, Kmart was the black sheep in parent company Wesfarmer’s portfolio, generating earnings before interest and tax of $114 million — well behind stablemate Target on $223 million.

With the brand reportedly slated for sale, Wesfarmers hired Guy Russo, former managing director and chief executive of McDonald’s Australia, to take the helm at Kmart. One of his first tasks: Slashing the number of stock-keeping units (or ‘SKUs’), reversing Kmart’s ‘more is more’ strategy and swapping periodic sales for a constant flow of discounts.

“When we removed the SKUs and dropped the price, we found our customer,” Russo told the “Scaling Up” podcast last year. “They were a customer that really wanted value.”

Kmart also gutted its reliance on brand names, leaving its competitors to squabble over the big-name labels. “Removing brands, I think that was the other masterstroke,” Russo said. “We used to sell some really significant brands, but when we dropped the price of underpants to a buck each, the brands weren’t selling at ten bucks each. All of the sudden, the brands took a natural death.”

Wesfarmers put faith in Russo’s vision, providing funds to renovate stores as the brand cut inventory costs. “Make them look like Disneyland,” Russo recalls telling colleagues.

Layouts changed, with traditional departments axed. Customers would no longer pop into the electronics aisle to buy a coffee machine. Instead, they would have to meander through the all-purpose ‘kitchen’ section, potentially picking up some new mugs and cutlery along the way.

“And then the last little masterstroke, although we got a lot of criticism for it, is we put the registers in the middle,” Russo said. The move forced customers to spend a few more moments surrounded by product, giving them one last opportunity to reimagine their home before stepping back into the world.

It was expensive, time-consuming, and one of the most successful brand rehabilitations in Australian history, with Kmart pulling off one of the hardest tricks in retail: convincing customers it was ‘affordable’, not ‘cheap’.

Shoppers didn’t flinch at the brand’s slightly less vast range – instead, they bought en masse, energised by the low prices. When Russo retired as chief executive of Wesfarmer’s department stores in 2018, the segment posted earnings before interest and tax of $660 million, led by “continued strong growth in Kmart”.

The rise of a new kind of online fan

Low prices and sheer ubiquity go a long way in describing why so many Australians became enamoured by Kmart.

Yet that does little to explain the phenomenal passion of its fanbase, and why thousands of teachers, doctors, stay-at-home parents and retirees evangelise for the brand in their spare time. Another development is on the hook for that one: after shoppers left Kmart’s new, central registers, they set up their new goods at home and shared the photos on Instagram and Facebook.

“The marketing got done by our customers, which was the best part,” Russo said.

“My Instagram actually began because of Kmart,” Helen James told Business Insider Australia. “I would go in store and just see so many cool, on-trend pieces for ridiculously low prices, and so I would take photos and then post them to my page.”

It didn’t take long for photos of Kmart homewares and decor — long dismissed as a cut-price alternatives to more desirable products — to fill James’ page. “It was all a matter of timing really,” she said. “Instagram was just starting to take off, Kmart was just starting to refresh their image and homewares range, and I basically bought the two together.”

Friends would tag acquaintances in her post, who’d then tag others, which eventually led to James’ account picking up 400 new followers a week. “People couldn’t get enough of seeing all the new products coming into store,” James added.

She was not alone. As smartphone cameras empowered shoppers to become the stylists and creative directors of their own fashion shoots, many turned to Kmart, a newly trendy store with a national footprint. Some held elaborate shoots, co-opting the visual grammar of magazine spreads and established bloggers, laundering Kmart’s image among the high-fashion milieu. Others simply strolled the aisles, taking photos of fleece jumpers, baby rompers, and coffee tables as they appeared in-store.

‘Lawyer by day, Bargain Hunter by night,’ reads the profile of Jasmine Pisasale’s Instagram account, which she started seven years ago as an escape from the “stressful” requirements of her job. “I found Kmart to be more than just a shopping experience,” she told Business Insider Australia. “I love to pass time walking through the stores… It brings me a sense of excitement – ‘what am I going to see in Kmart today?'”

The excitement translated to flatlays, wishlists, and travel shots, with each outfit item meticulously tagged back to the brand’s own Instagram account. Her lifestyle shots show artfully rumpled linens, throw blankets draped over low-slung armchairs and, more recently, Pisasale’s young son, exploring the beach for the first time while wearing a Kmart-branded bucket hat.

Fans have “watched me get married and have my first child along the way,” Pisasale said, noting the growth in follower numbers — around 32,000, at time of writing — as “steady” and “organic”.

“I have made connections with so many inspiring individuals from other accounts too,” she added. “So the growth has not just been in numbers, but also in new friendships and networks.”

James and Pisasale have leveraged their followings for active partnerships with the brand. Both have participated in invite-only Kmart events, which influencers use to share sneak-peeks at unreleased products with their own fans. Kmart used a familiar playbook to bring these social media figures onside, according to Dr Brent Coker, a lecturer in digital marketing at the University of Melbourne.

“A common strategy with influencer marketing now is called ‘always on’,” Coker said. “These are people who genuinely like your brand, and eventually they’re posting content, if they aren’t already, about how great you are. That kind of gets integrated into their life, which has been recorded through social media.”

Coker, who has written a book on viral marketing, says consumers “can smell when there’s a team of five marketers behind something from a mile away.” Latching onto social media users who already love your brand is an easy workaround.

“It’s almost cliche, that kind of statistic that gets bandied about, that consumers trust each other more than the brand nowadays,” he added. “But it’s just true.”

The world of Kmart ‘hacks’

As Kmart built clout on Instagram through glossy fan photoshoots, something stranger, and far less predictable, was happening on Facebook.

via Facebook

via Facebook

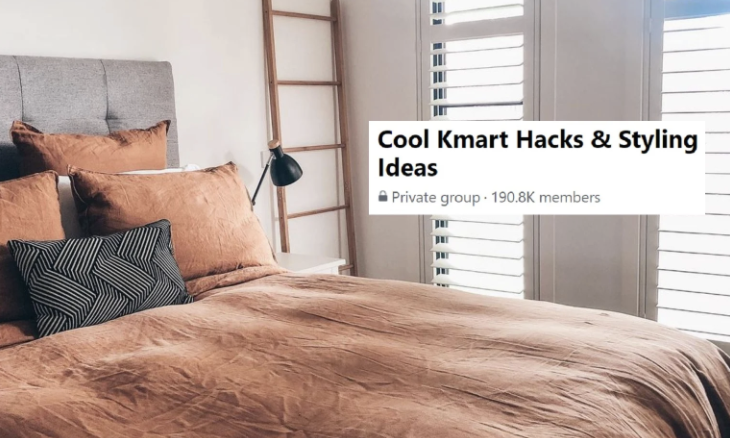

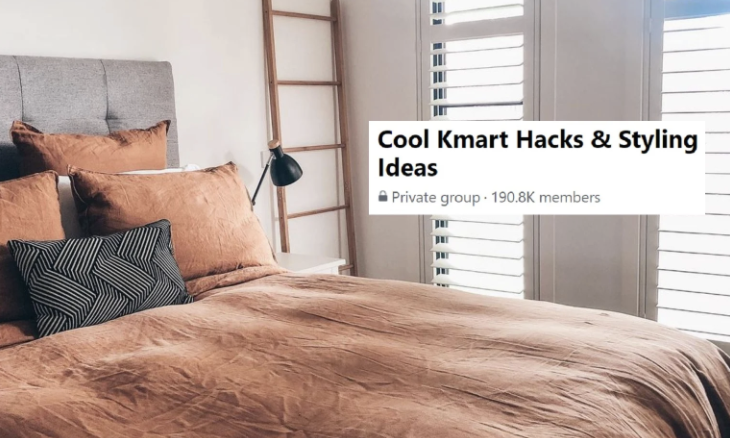

Kmart ‘hack’ groups, named for the way users repurpose Kmart products beyond their original and intended use, have become a dominant part of the Australian social media experience. Few Facebook users are too far removed from these enormous public forums, where woven baskets become lampshades, shower caddies are nappy holders, and chopping boards are refashioned as bath trays, styled with tea lights and sparkling wine.

One of the larger groups, founded in 2015, now boasts 470,000 members. If membership counted as adherence to a religion, it would be one of the largest faith groups in the country.

There are dozens of denominations of this all-encompassing faith. There are offshoots for Kmart weddings and Kmart pets, as well as groups for teachers, who festoon their classrooms with Kmart supplies. Some users devote their time to organisation hacks, posting photos of meticulously-labelled spice racks or ways to stuff unsightly TV cables into ornamental boxes. There is a group dedicated to recipes for Kmart’s cult-favourite pie maker with almost 65,000 members. There is even a ‘hacks for normal people’ group, for those reluctant to admit their appreciation for Kmart’s broad, recognisable aesthetic.

What is the Kmart ‘look’, exactly? The textiles are muted: beige and burnt ochre, rosy salmon layered over the blue-grey of eucalyptus. Tables, drawers, and shelving units are typically enamel-white, or “oak look”, which is a sunbleached woodgrain applied to cheap particle board. Accent pieces are pearlescent silver, quartz, or chalky coral. Rattan and cane are slowly supplanting Kmart’s mid-decade turn to bronze and ‘millennial pink’, leaving the overarching aesthetic casual, coastal, and deliberately inoffensive — a bootleg Scandi chic, suffused with salty air.

Kmart’s products are certainly more appealing than they were a decade ago. Their versatility is appropriate for everything from baby showers to Ramadan celebrations, both of which feature prominently in the biggest ‘hack’ groups. The brand name appliances and clothes Kmart abandoned have largely been replaced by Anko, the brand’s in-house label, which launched in 2019. Similar to Costco’s Kirkland line, Anko does a bit of everything, allowing Kmart’s 300-strong buying team to funnel wireless earphones, vacuum cleaners, and fan-favourite air fryers into stores nationwide.

But in the brand’s savvy attempt to ensure every product matches everything else, redecoration has become a largely shop-by-numbers process. It’s one thing to observe the details of a Kmart-hacked lounge room, but flipping through the endless stretch of white and subdued earth tones sprawled over social media has a distinct numbing effect; an overwhelmingly pleasant vibe you might call ‘Byron purgatorial’.

The effect is most pronounced on Facebook. While Instagram fosters the curation of a distinct personal brand — “lawyer by day, bargain hunter by night” — Facebook unsubtly guides users into open forums, where ‘successful’ room transformations are celebrated through thousands of likes and comments. Looks the community deems distasteful are torn down in spectacular fashion. Many groups, for example, outright ban posts featuring Kmart’s infamous marble-effect book contact, after users were condemned for covering entire countertops with it. By virtue of Facebook’s voracious algorithm, users are more likely to see the most ‘successful’ looks, making them even more likely to be replicated in real life and then, in turn, fed back into Facebook.

The virality of these hacks has not gone unnoticed by Australian news organisations, either. Outlets regularly aggregate and package popular hacks into snappy, attention-grabbing pieces of online content. There’s Daily Mail Australia with ‘Shopper transforms Kmart shelves into chic furniture’; News Corp’s parent-centric KidSpot with ‘Kmart hack: How to turn $8 fruit bowl into mesh light shade; and 7 News, which now dedicates several articles a week to ‘cult buys’ and other Kmart-related phenomena. These articles then return to Facebook, reaching users who might have otherwise missed ‘Mum’s genius Kmart bedhead hack’, or ‘The secret sale section at Kmart with ‘heavily-reduced’ markdowns that you had no idea about’.

This feedback loop has reverberated into living rooms across the nation. It has homogenised suburban interiors, and certainly generated massive revenue for the brand. And it has transformed the ‘hack’ community into one of the most powerful forces in the Australian influencer economy. Kmart fan groups and influencers now serve as an open-air focus group, filling a board room which spans the continent.

Their dreams and desires have translated into an expanded toy range reflecting the diversity of Kmart’s customer base, a revamped take on the aforementioned pie-maker — which probably deserves its own analysis as a cultural artefact — and an overhaul of the brand’s fashion offerings. “I recall some influencers at a past event asking about the possibility of expanding their plus size range, and the style team took it on board and made significant efforts to expand the styles available,” Pisasale said.

“They really do listen to community feedback, which I love,” James added. “Womenswear, the Curve Collection, the quality of materials, the introduction of more sustainable products … I think over the years all of these improvements have really been driven from a grass roots level.”

But Kmart does not pay any of the influencers associated with its brand for these insights, be they polished Instagrammers or time-poor parents sharing pictures of their spice rack.

“As a business we do not do paid or sponsored content,” a Kmart representative told Business Insider Australia. “Rather we have a ‘gifted for review’ program where media and social media influencers are sent product (where relevant to them or their family) to review, trial and are encouraged to share their feedback.”

The uneasy relationship between marketing and ‘playbour’

Analysis of the influencer market suggests Kmart is getting a bargain.

A 2020 report by global social media analytics firm HypeAuditor found Australia’s professional Instagrammers — that is, creators who earn money on the platform by advertising brands and products to their followers — can command four-figure fees per post, even without the reach of homegrown superstars like Chris Hemsworth or Margot Robbie.

The report defines creators like James as ‘macro-influencers,’ who boast follower counts between 100,000 and 1 million, as “famous in a local community”. Creators in this tier can be expected to charge up to $1,200 for a sponsored post. Those with more concentrated followings, between 20,000 and 100,000, can bill brands up to $250 for access to their audience.

On the bottom rung are ‘nano-influencers’, the “regular consumers who are passionate and willing to share, but have little influence.” These figures can expect to earn $10 to $50 per post, if they earn at all. But these creators trade reach for engagement, the default measurement of a post’s impact. A major Australian celebrity might be expected to draw an engagement rate of 2.2%. This figure doubles for Australian nano-influencers.

The mode of influence changes, too: instead of a top-down relationship, nano-influencers reach each other in an omni-directional transfer of ideas, tastes, and aesthetics. The same pattern is exhibited by Facebook group members, even if the influencer economy has traditionally treated them as customers, not creators. For a brand like Kmart, the question then becomes one of scale: Why pay for access to one celebrity’s Australian audience, when everyday Instagrammers and a hivemind of 450,000 Facebook users will promote your product for free?

Catherine Archer, a senior lecturer in strategic communications at Perth’s Murdoch University, is one of several academics focused on digital ‘playbour’, the sticky middle ground between online fandom and paid service to a brand.

The benefit of these groups to Kmart is obvious, she said. But unlike traditional influencers, whose success is determined by click-through rates, it is harder to calculate their objective value to the brand. This under-researched commercial relationship makes compensation difficult to determine, if the conversation comes up at all.

“It’s all a bit blurred when you get to the ethics of interacting with people who are just like us, the everyday community,” Archer said, adding that participants “sometimes people don’t realise how absolutely amazing they are for that brand.” Savvy operators can forge careers out of online fan accounts, but for the most part, there are “a lot of people who don’t make any money out of it.”

Certainly, nobody is forcing hundreds of thousands of bargain hunters to proselytise for Kmart. The influencers Business Insider Australia spoke to expressed their genuine devotion to the brand, and appreciation for the way staff took their messages onboard. Not every fan group needs, or deserves, financial compensation from the causes they profess to support, and not every aspect of digital life should be packaged and sold to the highest bidder.

But it is hard not to see Kmart’s fan community as a case where the brand takes at least as much as it gives.

“Customer feedback through all of these channels are incredibly important to the entire Kmart team from design, buying, our quality technicians, stores and across to our distribution centres,” a Kmart spokesperson told Business Insider Australia.

“It allows us to listen to our customers, apply learnings where possible and continue to deliver great quality products at the lowest prices for everyone in the family.”

The brand does listen closely. At least one major ‘hack’ page, which does not advertise any official relationship with the brand, appears to be quietly administered by Kmart employees.

The company did not respond to questions about that group.

In his podcast appearance, Russo casually mentioned that at one point in his tenure as CEO, women accounted for 85% of sales. A cursory glance at the Kmart fan community suggests a similar demographic split. What these groups are, then, is a chance for Australian women to celebrate domestic ingenuity, and the unselfish, underappreciated labour of making a home. They are places for mothers — financially isolated compared to their male counterparts, yet contributing a disproportionate percentage of household labour — to find entertainment, inspiration, and community.

“I did some research about mothers using Facebook a few years ago, doing some focus groups and surveys,” Archer said. “And some of the reasons for being on Facebook were that sense of escape, to be in closed groups for advice, and genuinely to just sort of escape from boredom in some ways.

“But also feeling part of that connection to communities. And Kmart groups meet all of that.”

“We don’t use the word instinct, but it’s an instinctual sort of behavior, you know,” Coker added. “Once upon a time, it was beneficial for your survival to belong in a group… It’s kind of biologically programmed.”

But when some of the largest forums in Australian public life operate in service of commerce, should its participants not receive compensation for their contributions to the brand? And what good is a system which promises alienation for those who opt out altogether?

“What came up in the focus groups I did with mums of young children is that it’s very hard not to be on Facebook, because you feel a bit tethered to it,” Archer continued. “Because like I said, all the parties are on there, or everything’s on them. It throws you back in. And we know they work very hard to keep drawing back in, even if you don’t want to be drawn in.”

That Kmart became the beneficiary of an atomised society almost seems accidental, a fortunate addition to the brand’s offline overhaul. Any department store offering fashionable, cut-price goods could have feasibly profited from Facebook’s monopolisation of digital life. Regardless, brands will learn from Kmart’s example. And they will see community as a product, waiting to be repurposed.