Industry, union and business leaders spent two days hashing out details on the future of Australia’s workforce. Here’s what they landed on.

Over 140 heavy-hitters from business, union, industry and political circles gathered in Canberra this week to discuss critical and ambitious plans to reform the Australian economy by boosting workforce participation, increasing productivity and putting plans in place to boost real wages.

The lineup was impressive – attendees ranged from industry and union leaders, such as the Australian Council of Trade Unions Secretary Sally McManus and Australian Industry Group’s CEO Innes Willox, to business magnates including Fortescue Metals’s CEO Andrew ‘Twiggy’ Forrest and Atlassian’s CEO Scott Farquhar.

These conversations on the future of Australia’s workforce are occurring at a critical juncture in time. Australians are facing soaring cost-of-living issues, employers are struggling to navigate the tightest labour market in recent history and the government is dealing with eye-wateringly high levels of national debt.

This means that every attendee had an agenda; each person felt their issue should be set as a priority, and not everyone will walk away happy.

Treasurer Jim Chalmers is not blind to this fact and, in his opening address, noted that bringing these disparate groups together would result in some challenging conversations, but said he felt cautiously optimistic about what the collective group could accomplish.

Here are some of the key issues and announcements to come out of the two-day summit.

1. Wages

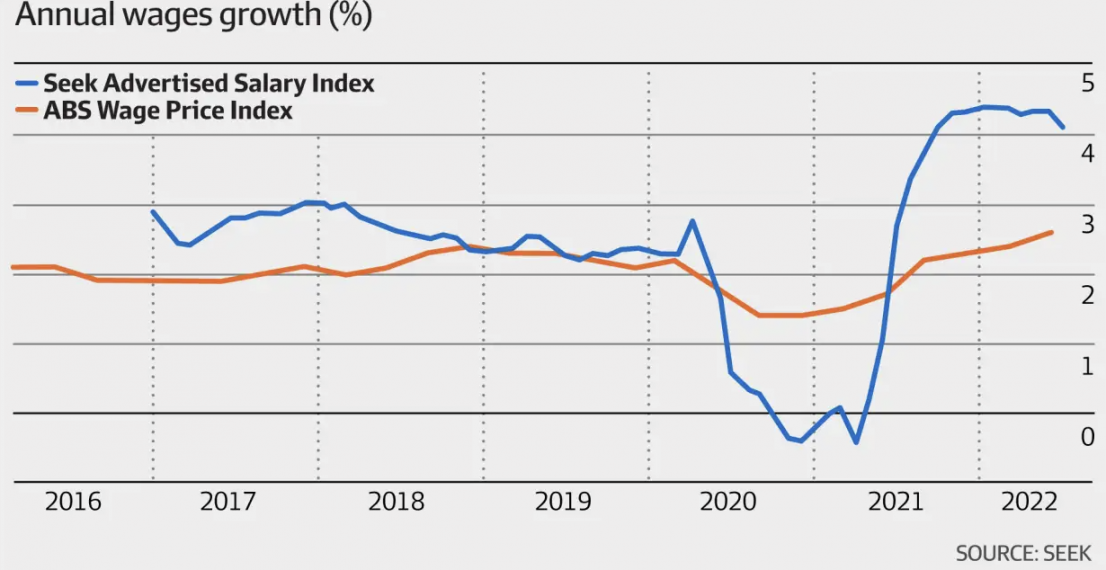

While discussions at the Jobs Summit were certainly varied – declining productivity, low female workforce participation rates, the introduction of multi-employer bargaining – they all ladder up to many people’s key concern: responding to the fall in real wages growth.

And it’s no wonder. Australia’s decline in wage growth has been a hot-button issue for years now. And despite recent ABS statistics showing that wage growth rose by 2.6 per cent this year, the accompanying inflation pressures mean this isn’t translating into a benefit for employees.

Public versus private wages from 2012-2022

State and territory breakdown of 2022 wage growth

This will no doubt continue to make headlines over the coming months, but the government hopes that many of the decisions made during the summit will help to ease pressures.

2. Productivity challenges and female workforce participation

To boost wages, you need to boost productivity, said the Grattan Institute’s CEO Danielle Wood.

Speaking to delegates, Wood stated:

“While productivity remains the secret sauce of higher incomes, it is worth noting that recent research finds some reduction in the share of productivity gains passed through to workers over the past 15 years.

“No matter how you cut it, the rate of productivity growth has slowed over the past decade. Over the past 60 years, our labour productivity improved at an average rate of 1.7 per cent a year. Over the decade to 2020, it was 1.1 per cent a year.

“This is not just an Australian phenomenon. The slowdown has been seen around the developed world, although our relative performance has also slid down the international rankings. Everyone is running slower, but Australia is also falling back in the field.”

Wood suggests these productivity concerns could be partly remedied by putting more resources into getting women back into the workforce.

“Women are often excluded from full-time work, and from the most prestigious high-paid roles, because these so-called ‘greedy jobs’ are incompatible with the load of unpaid care still disproportionately shouldered by women,” she said.

According to Katy Gallagher, Minister for Finance, Women and the Public Service, if female participation in the workforce matched men’s, the economy could be 8.7 per cent larger by 2050.

As has been widely discussed and reported on, the pandemic has pushed back years of incremental wins for women in the workforce. As the graph below demonstrates, we’ve been making progress following a 19 per cent gender pay gap peak in 2014, but since the pandemic, that gap has started widening once again.

Australia’s gender pay gap from 2012-2022

This drop in pay also coincides with a drop in female participation rates in the workforce, due to many women working in insecure jobs (hospitality, retail and tourism) and increasing the amount of unpaid labour they took on during the pandemic years.

“We can’t keep asking women to babysit the economy,” said Equality Rights Alliance’s Secretariat Helen Dalley-Fisher.

“We have to shift the distribution of unpaid work, and we have to change our workplaces to make this possible. We should expect everyone to work flexibly at some point in their careers as they meet their fair share of caring work.”

Australian workforce participation rates for men and women 2012-2022

Experts say the solution to this lies in better childcare support for working families.

In response to this, many have called on the government to bring forward its $5 billion childcare subsidy plan, which is currently set to be included in the October 2022 budget.

The plan would give families with a combined income of up to $80,000 a 90 per cent subsidy for childcare for their first child. Support would also be offered to families with a combined income of up to $530,000.

“We can’t keep asking women to babysit the economy.” – Helen Dalley-Fisher, Secretariat, Equality Rights Alliance.

KPMG’s National Chair, Alison Kitchen, was one of the voices in support of the subsidies.

“Policies to reform [subsidies] in the childcare sector are sound investments with tangible economic benefits. They’re not welfare. For every dollar invested in those policies, the nation’s GDP is boosted by almost $2.”

However, the government claims it cannot bring this subsidy forward due to the “massive debts” inherited from the previous government, and states that the $5 billion plan will still help thousands of working families when it’s introduced in the new financial year.

Speaking to HRM, Professor Ben Hamer CPHR, AHRI board member and Adjunct Professor at Edith Cowan University, says that while he understands the need to address childcare needs to support female participation at work, he is “perpetually frustrated” that this is framed as a women’s issue.

“It’s a family issue, and as far as employers are concerned when they’re looking to leverage untapped talent in a tight labour market, it’s absolutely an organisational issue,” says Hamer.

“We need to recognise that the nine-to-five, five-day-a-week model has been around for over 100 years. And yet women were only granted the full adult wage in Australia less than 50 years ago.

“It was a system designed by men, for men. And so we need to fundamentally change the system.”

One way he suggests doing this is by embracing more flexible ways of working which, he acknowledges, most organisations are already doing but suggests that efforts should be more “radical” – such as scrapping the work-hours model completely and focussing on output alone.

“We also can’t underestimate the importance of appropriate female representation at the most senior levels. And I’ll give you an example. When you look at the organisations mandating office attendance… you’ll find it’s rarely coming from female CEOs. Read into that as you will.”

3. Multi-employer bargaining and simplifying the Better Off Overall Test (BOOT)

One of the more contentious items on the summit’s agenda was the introduction of multi-employer bargaining agreements.

“Multi-employer bargaining gives unions the ability to strike agreements for workers across a number of organisations in the same industry,” says Hamer.

Only a few hours into the summit, Workplace Relations Minister Tony Burke announced that the government was prepared to take “immediate action” to enable multi-employer agreements and to simplify the better off overall test (BOOT), which was introduced in 2009 by the Rudd government.

While the government concedes that the BOOT is in need of an overhaul – Treasurer Chalmers told ABC’s 7:30 it was “not sufficiently simple, fair or flexible enough for workers” – it’s standing steady in its plans to shake up enterprise bargaining.

“The changes that have been worked through right now will make a real difference to business being able to employ people, and people being able to make ends meet with decent pay rises into the future,” said Burke.

Those in low-income jobs are already able to enter into multi-employer agreements, but this process has been criticised and called “a failure”. Industry leaders are calling for more details to be released to give a better sense of what a wide-scale approach would look like, and how it would differ from current processes.

RMIT University professor, industrial relations expert and summit attendee Anthony Forsyth said that current individual enterprise bargaining “completely ignores how businesses have evolved”, noting that our new-found reliance on labour hire and outsourcing needs to be taken into account.

However, there’s plenty of opposition to this plan, notably from industry leaders and the political opposition.

Shadow Employment Minister Michaelia Cash, who was not present at the summit, said multi-employer bargaining would be “devastating” for the economy, as it could increase strike activity across sectors. And Innes Willox, CEO of the national employer association Ai Group, said such changes would be “seriously misguided”.

“We can, and must, make it much easier for small employers to engage in enterprise bargaining that enables agreements to be relevant to the genuine needs of the business and the employees,” Willox said in a statement. “We should definitely not subject them to a one-size-fits-all approach of sector bargaining and the prospect of damaging industrial action.”

Despite this opposition, Burke said consultations to legislate these changes are likely to begin next week and hopes the legislation will be introduced by the end of this calendar year.

This move could very well be a defining feature of the Albanese government – for better or for worse.

3. Skilled migration and homegrown talent

One of the key ways to breathe life back into the Australian workforce from a skills perspective is to introduce more visas for highly skilled migrants.

On day two, Home Affairs Minister Clare O’Neil announced a temporary 35,000 increase to Australia’s migration intake cap, bringing it to 195,000.

Regional migrant positions will also increase from 9000 to 34,000, as will state and territory sponsored visas (11,000 to 31,000).

“This is absolutely a step in the right direction to ensuring the right migration mix to support skill needs and labour market demands,” says Hamer. “But we can’t overlook the need to bring in more temporary workers, such as those on Working Holiday Maker (WHM) visas to bolster our hospitality, agriculture and tourism sectors, particularly as we head into the Christmas season.

“And it’s not just about giving out visas, but creating the right conditions to entice and retain these workers. For example, there are over 70,00 backpackers with valid WHM visas currently outside of Australia who could travel and work here if they wanted, but have chosen to stay out of the country.”

“Now is the perfect time to take stock of where we’re at, identify current and emerging risks to the labour market, and come up with a plan for safeguarding our economy in the long run.” – Dr Ben Hamer CPHR, AHRI Board Director

O’Neil added that the government’s focus is firmly on Australian jobs first.

“That’s why so much of the summit has focused on training, and on the participation of women and other marginalised groups,” said O’Neil. “But the impact of COVID has been so severe that even if we exhaust every other possibility, we will still be many thousands of workers short, at least in the short term.”

Annie Butler, Federal Secretary of the Australian Nursing and Midwifery Federation, warned against using temporary overseas workers as disposable resources.

“To ensure we have the skilled workforce we need we must plan appropriately, train our local workforces, and then encourage overseas skills through permanent migration programs.”

Joanna Howe, University of Adelaide associate professor in law, is also in favour of permanent migration policies, as she believes the “poor quality” of temporary visa jobs, in terms of conditions and pay, make for a ‘revolving door’ situation.

Columnist and former Deputy Secretary of the Department of Immigration, Abul Rizvi, added to this point, stating: “We are now barrelling towards becoming a fully fledged low-skilled guest worker society.”

This means we need to make plans to bolster homegrown talent in conjunction with an increase in migrant workers. To this point, the government announced an extra 180,000 fee-free TAFE places as of 2023, totalling $1.1 billion.

“We want to see more Australians gaining the skills they need to find good jobs, in areas of national priority,” Prime Minister Anthony Albanese said to summit delegates.

Notable mentions

That covers the big-ticket items discussed over the two days, but here are some other noteworthy announcements and discussion points that are worth mentioning.

- The government plans to offer better flexible working arrangements and access to unpaid parental leave to assist families in sharing the load for care work.

- Michelle O’Neil, President of the ACTU called for the paid parental leave scheme to be increased from 18 to 26 weeks immediately, and to be increased to a full year by 2030 in order to boost economic activity.

- More power will be given to the Fair Work Commission to get involved in unfair bargaining practices.

- A national construction industry forum will be created to manage safety, mental health, training, productivity, culture, gender and diversity in the industry.

- Albanese announced that his government would keep stage-three stage cuts, despite initial calls from the Labor government to scrap them.

- $36.1 million has been pledged to increase staff capacity in visa processing centres by 500 over the next nine months.

- Experts are pushing for more innovation to come out of Australia. We’re currently rated 25th in the world in terms of product innovation and 23rd for collaborative patents, said Queensland University of Technology Vice Chancellor Professor Margaret Sheil. Australia invests 1.8 per cent of its GDP into research and development compared to 2.3 per cent across the OECD.

- Peter Dutton, who didn’t attend the summit, urged the government to consider letting older Australians back into the workforce without having to forgo their government benefits. Albanese responded by announcing a $4000 work bonus income bank credit for pensioners, allowing them to engage in more work. This will be available until June 30 2023.

- An increase in training and jobs for Indigenous Australians and culturally and linguistically diverse people. This will include 1000 digital apprenticeships in the Australian Public Service.

- Australian of the Year and tennis pro Dylan Alcott called for people living with disability to be able to pick up more hours of work without having to forgo any of their disability support payments.

Next steps

No matter what side of the fence you sit on regarding these issues, it seems clear that this government is committing to walking the talk with its proposed changes – and that proactivity is certainly going to make an impact in critical areas.

“The best time to develop strategic policy is not in reaction to when things are bad and reap the benefits years down the track,” says Hamer. “Now is the perfect time to take stock of where we’re at, identify current and emerging risks to the labour market, and come up with a plan for safeguarding our economy in the long run.”