Incoming Qantas chief executive Vanessa Hudson says the airline’s balance sheet is “stronger than it has ever been in our history”, providing options to manage aircraft orders and investor returns until the end of the decade.

The company has $10 billion of liquidity available to it – a collection of cash, undrawn debt, but mostly aircraft that Qantas could secure loans against – she said at its first investor day since 2019. Debts were below targets, with $650 million of the most expensive loans paid off in advance.

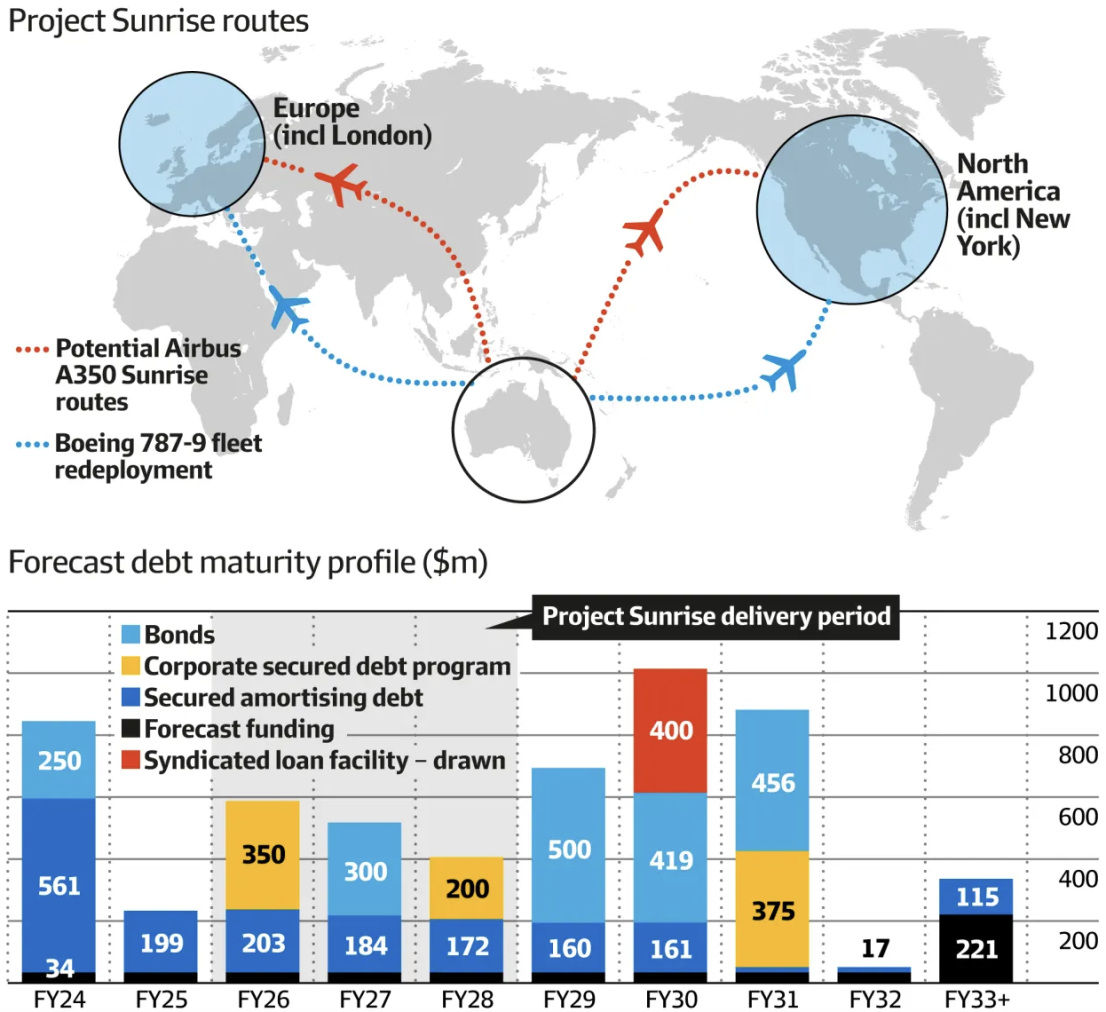

Ms Hudson said this was done to minimise debt repayments between 2026 and 2028. Capital expenditure, including for new planes, is expected to top out at $3.2 billion in the 12 months to the end of June 2024.

Qantas says its new fleet will be younger and more efficient than those flown by Virgin Australia, and operating direct flights from Sydney to London and New York will deliver the airline sustainable profits.

Outgoing Qantas CEO Alan Joyce said the airline’s order for new aircraft, placed during the COVID-19 pandemic, had allowed it to secure planes that were now “as rare as hens’ teeth” amid high demand.

“We did [order planes] through the competition in the middle of COVID where nobody was ordering aircraft, and we got access to very attractive pricing,” Mr Joyce said.

“Vanessa led the deal on this very attractive pricing, very attractive delivery slots, and you talk to Boeing and Airbus now they’re essentially full for most of the rest of this decade.”

Mr Joyce told investors that new technology was central to Qantas’ plan to outperform rivals and improve margins. The next-generation aircraft are expected to transform Qantas, reducing costs through better fuel efficiency and longer-range performance.

Andrew David, the airline’s head of international and domestic, said the new planes would reduce Qantas’ average aircraft age to 9.9 years by 2027, from 16.4 years today.

In the domestic market, Mr David said modelling of Virgin’s 737 Max deliveries put the average age of Qantas planes below its rival’s by 2027.

And as Virgin readies to resume its initial public offering roadshows, Mr David said the total domestic profit pool in Australia would have grown by 80 per cent to $2 billion by the end of financial year 2023 compared with the five years before the pandemic.

“The growth has been driven by permanent structural cost transformation from Qantas and Virgin and the current market environment, and is considered a sustainable and rational position after Virgin’s administration,” he told investors on Tuesday.

Mr Joyce said Qantas’ incoming narrow body Airbus jets “are a lot more capable aircraft, a lot more cost-effective aircraft, and they give us a major strategic advantage”.

In the international business, Qantas expects its ultra-long-haul Project Sunrise flights to Europe and North America will deliver $400 million of earnings in the first full year it has all 12 aircraft flying.

The airline will launch the first of these services – Sydney to London – in 2025, with its network of 19-hour-plus journeys fully operational in financial year 2030, according to an investor presentation.

Some 41 per cent of the new seating on the Airbus A350s will be classed as premium, compared with 30 per cent on the Boeing 787-9 that flies passengers from Perth to London.

The new fleet would form a key part of what is now a “structurally different business” compared to its pre-pandemic structure that Virgin would not be able to replicate, Mr Joyce said.

Qantas had learned from flying Perth-to-London direct that customers want – and will pay more for – point-to-point long-haul flights, Mr David added.

Profitable routes

“People are willing to pay a premium to fly direct, and it’s even more so since COVID ... That’s why we’ve got the confidence to launch an aircraft that’s got 41 per cent of its seats in premium configuration,” he said.

When the new Airbus A350 jets are operating, Qantas predicts they will help deliver “incremental earnings in excess of [around] $400 million” annually by 2030.

If achieved, it would likely mean these routes are some of the most profitable of its international network, which produced $464 million in earnings before interest and tax in the six months to the end of December.

Other key points include a target for Qantas Loyalty to deliver up to $1 billion of earnings by 2030, powered by a “targeted expansion in financial services and insurance”.

On the closely watched fleet renewal project, which analysts expect will cost up to $15 billion over the next five years and see the airline take delivery of nearly 300 aircraft over the next decade, Qantas says strength in the balance sheet will provide “continued access to diverse capital, preferential pricing, terms and conditions”.

The investor presentation will be the last for Mr Joyce, who is set to leave the airline in November.

“We’ve been clear on the significant level of investment in the pipeline, and today we’ve given some detail on the returns we expect from it,” Ms Hudson said.

“We’re confident in reaching our [financial year 2024] margin targets, and we’ve set some ambitious but achievable earnings goals beyond that because we think ambition is key to long-term performance.”

Qantas shares closed 17¢, or 2.7 per cent, higher on Tuesday at $6.59.

The airline last week flagged profits before tax would reach between $2.425 billion and $2.475 billion for the 12 months to the end of June. Qantas Loyalty was on track to reach the top end of its underlying earnings target of between $425 million and $450 million for the year, the company said.