Qantas boss Alan Joyce says the Omicron COVID-19 wave has set the airline’s pandemic recovery back by six months and expects domestic and international travel demand to return more slowly than previously anticipated.

The country’s biggest airline on Thursday reported a $1.28 billion underlying loss for the six months to December 31, worse than its $1 billion first-half loss last year, as flying activity fell to just 18 per cent of pre-COVID levels.

Mr Joyce said that with most of Australia in lockdown during parts of the half, the result “isn’t surprising, but it is frustrating”, while adding there had been a “sharp uptick” in international bookings and improved domestic demand in recent weeks.

However, the group cut both domestic and international capacity forecasts for the June quarter across both its Qantas and Jetstar brands.

Domestic flying would be 90 to 100 per cent of pre-COVID levels, down from earlier expectations of 114 per cent while international flying would be 44 per cent, down from 60 per cent, as major markets such as New Zealand, Indonesia, Japan, Hong Kong and China delayed opening their borders.

“There’s no doubt Omicron ... did slow down that recovery and there is a tail effect on this,” Mr Joyce said.“It’s pushed everything out by about six months from where we thought we would be.”

Domestic business travel was recovering the slowest, he said, but should bounce back in the coming weeks as the requirement to wear a mask in offices lifts in NSW and Victoria.

“[Removing masks] is a prerequisite to get people flying again, and a lot of corporates are telling us that,” Mr Joyce said.

The Omicron wave will cost Qantas $650 million in the June half, and another $180 million from “inefficiencies” such as bringing all staff back to work even while passenger numbers lagged.

Jarden analyst Jakob Cakarnis said these costs could lead to “meaningful” revisions to market forecasts for Qantas’ full-year earnings.

Qantas shares fell 5 per cent to $5.08 on the result, against a 3 per cent decline on the ASX 200 which was rattled by the military conflict in Ukraine.

Flight Centre managing director Graham Turner said even though Australia’s border was now open, travel was held back by restriction in some of our biggest travel markets like Japan, China, Fiji and Indonesia.

“People aren’t going to travel to Bali and spend three days in a hotel,” he said, after handing down his own half-year results.

However, Mr Turner said that based on discussions with major foreign airlines, international seat capacity into Australia was set to jump from around 22 per cent of pre-COVID levels currently to 60 per cent in April.

“Once the capacity is there everyone can start really pushing the advertising - there’s a lot more marketing and a lot more travelling both outbound and inbound.”

Air New Zealand chief executive Gregg Foran told this masthead on Thursday that only about 9000 people were booked to fly from Australia across the Tasman in the three weeks after Sunday, when the country will let arrivals isolate at home for seven days rather than enter hotel quarantine.

“It’s effectively a blip,” he said, when compared to the flood of travellers crossing the Tasman when the Australia-New Zealand travel bubble was open last year. “It’s good to begin the journey to get that down to a week but until it [the isolation requirement] is actually removed, you just have too much friction for people to travel en masse.”

Flight Centre shares fell 10 per cent to $18.09 on Thursday after it reported a $188 million first-half loss, which $52 million deeper in the red than consensus market forecasts. Mr Turner said the group should be profitable again, on a monthly basis, by the end of the financial year.

Air New Zealand’s dual-listed ASX and NZX listed shares fell 3.4 per cent $1.43, after it reported a statutory after-tax loss of $NZ272 million ($254 million), down from $73 million loss a year earlier.

Qantas reported earnings before interest, depreciation and amortisation of $245 million, which was $41 million worse than analyst consensus forecasts, as revenue grew $744 million to $3.07 billion.

Its statutory loss narrowed from $1 billion to $456 million, however, after it sold a parcel of land at Sydney Airport for $802 million late last year. That helped Qantas lower its net debt from $5.9 billion to $5.5 billion, which is the top of its targeted range and which Mr Joyce said positioned it to order new short-haul and ultra-long haul aircraft this year.

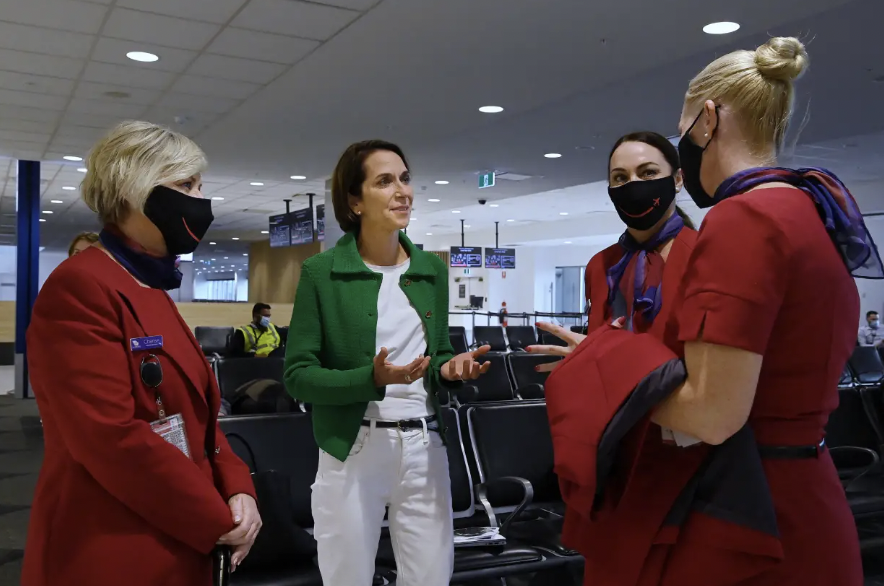

Qantas said it will give rights to 1000 company shares each - worth $5350 at their current price - to its entire workforce - 20,000 non-executive employees who over the past two years had endured long stand-downs and wage freezes.

The rights will convert to shares in August next year, providing the employees stay with Qantas and the company meets key targets in its “COVID recovery plan”. Executives - who have not been paid short-term bonuses during the pandemic - and senior managers will also be eligible for share-based bonuses next year.