Salaries for jobs advertised on online hiring platform Seek surged 4.1 per cent in July compared to a year earlier, adding to wide-ranging evidence that wages are picking up strongly in the second half of the year.

Seek’s inaugural Advertised Salary Index measuring the growth in salaries across the 200,000 listings posted each month suggests that the ultra-low 3.4 per cent unemployment rate is forcing employers to offer fatter pay packets to secure workers.

The higher pay rises for people switching jobs is happening across a wide range of white and blue-collar industries, for lower end and higher end jobs.

Advertised salaries for designers and architects jumped 7.3 per cent to an average of almost $90,000 over the last 12 months, while information and communication technology pay rose 6.2 per cent to an average of $130,000 annually.

Advertised salaries for mining, resources and energy salaries increased 5.7 per cent to $126,783, real estate pay jumped 5.7 per cent to $81,081, manufacturing, transport and logistics rose 5.2 per cent to $69,197, accounting was up 4.9 per cent to $90,993, and marketing and communications increased 4.7 per cent to $93,693.

Job ad salaries for tradies rose 6.1 per cent to $71,797 and administrative and office support workers’ pay increased 5.8 per cent to $63,516.

The survey, to be launched on Monday, is an indicator of future wage growth.

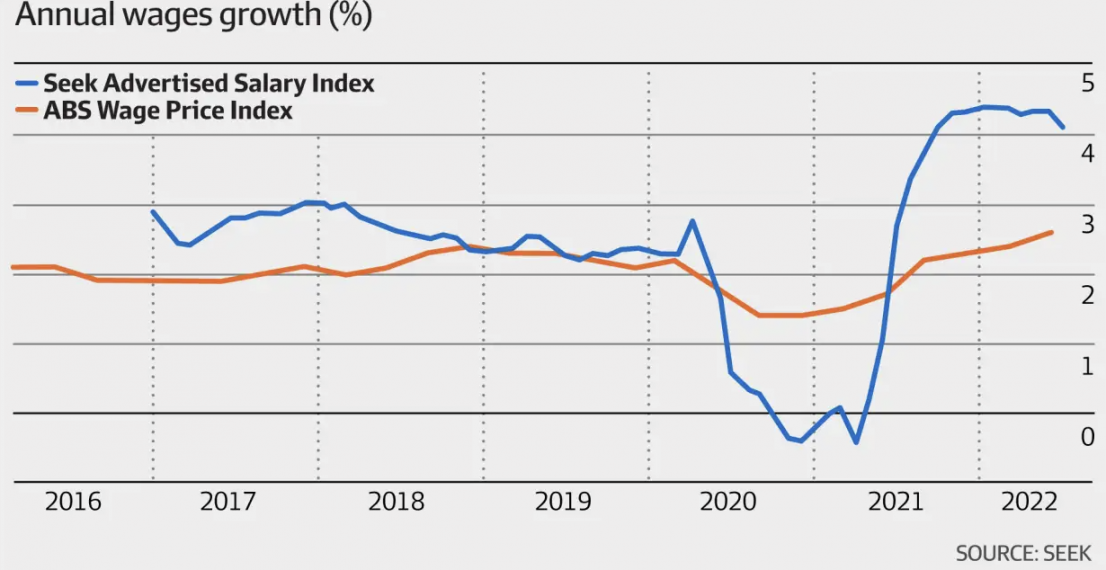

The Seek data for the new financial year in July is more recent than the official Australian Bureau of Statistics wage price index which showed wages rising modestly for all workers by 2.6 per cent in the June quarter.

Seek senior economist Matt Cowgill said it was “clear” wages and salaries were picking up.

“Competition for talent is fierce, with the unemployment rate at a near 50-year low. The pick-up in advertised salary growth has been broad-based. Most types of jobs are seeing annual advertised salary growth greater than 3 per cent,” he said.

The data adds to evidence that wages growth is picking up.

The minimum wage and award wages rose between 4.6 per cent and 5.2 per cent for 2.7 million workers in July.

For the 15 per cent of workers who scored a pay rise in the June quarter, the average increase was a healthy 3.8 per cent (excluding a superannuation increase), the highest since the mining investment boom in 2012, according to the ABS.

Adding in the 0.5 of a percentage point increase in the superannuation guarantee to 10.5 per cent from July, these bonus-and-commission-incentivised workers received a 4.3 per cent remuneration increase.

Compelling evidence

State governments have also lifted their public sector pay caps.

The Reserve Bank of Australia’s business liaison program suggests that more than half of employers will award pay increases of more than 3 per cent over the next 12 months, while the National Australia Bank business survey, business leaders and union pay claims are also pointing to bigger wage rises.

Business Council of Australia chief economist Stephen Walters said: “Wages are increasing and there is a lot of compelling evidence that wages are going to be picking up over the next six to 12 months.”

When companies list an ad on Seek they include a salary range for the position (which may or may not be visible to the candidate), giving the job site a wide cross-section of data across industries, seniority and geography.

Advertised salaries grew across all states and industries in the 12 months to July 2022, with the lift in advertised salaries likely to precede a broader increase in wages growth across the economy.

The public service, healthcare, and education and training experienced slower growth in advertised salaries.

“Government and industries where there is strong government involvement, either as an employer or indirectly as a funder, are tending to see lower growth and advertise salary,” Mr Cowgill said.

While Seek’s ASI and the ABS wage price index were on a similar trajectory before the pandemic, Mr Cowgill noted the advertised salaries tended to fluctuate more than the ABS wages measure.

“If you think through from the perspective of an employer, you’re much more able to adjust salary – in both directions – that you are offering for new starters than you are to adjust the wages for existing staff,” Mr Cowgill said.

“When things change, like the unemployment rate has been on kind of a roller-coaster the last few years, advertised salaries are much quicker to adjust to those changes in the labour market in the economy than overall wages.”

‘Apples with apples comparison’

When the pandemic hit, growth in advertised salaries slowed rapidly, nearing zero and started growing more rapidly in mid-to-late 2021, as the economy reopened.

The survey is an “apples with apples” comparison of pay by monitoring salaries for the same types of advertised jobs over time.

The data will be released monthly, more frequently than the quarterly ABS wage price index.

Advertised salaries grew the fastest in the Northern Territory (5 per cent), followed by Western Australia (4.9 per cent), Tasmania (4.8 per cent) and Queensland (4.7 per cent).

South Australia (1.9 per cent) and the ACT (1.8 per cent) were the only two states or territories to record relatively modest advertised salary growth.