Priceline Pharmacy owner API has reported a 4.1 per cent increase in Group revenue to $4.0 billion, as the flagship health and beauty retailer saw like-for-like sales return to growth.

API reported net profit after tax of $56.6 million, up 17.4 per cent on the prior corresponding period, as its businesses reported growth in market share.

Priceline Pharmacy, Consumer Brands and Clear Skincare all reported growth in market share and contribution while its Pharmacy Distribution business had solid cash generation and stable market share.

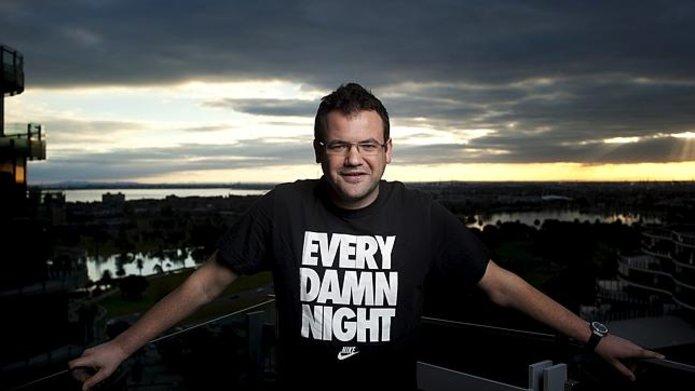

“Our core business performed to expectations, with Priceline Pharmacy reporting improving like-for-like sales growth throughout the year and Pharmacy Distribution holding market share in a competitive environment,” API CEO and managing director Richard Vincent said in the results announcement on Thursday.

The Group’s net debt levels however increased from $55.9 million to $199.1 million over the year to August 31 due to the costs of purchasing a 12.95 per cent stake in Sigma Healthcare, an investment in Consumer Brands inventory and investing in Clear Skincare clinics.

Since the acquisition of Clear Skincare, API has expanded the network to 52 clinics.

Priceline Pharmacy’s total network sales for the period were up 2.4 per cent to $2.2 billion.

Vincent said a lot of focus has been put on the timing and attractiveness of Priceline’s promotional offers, alongside major product launches and category development initiatives which proved popular with customers and drove increased footfall.

The store network grew by a net 13 stores during the year to 488 in total. While the franchise network grew, the number of company-owned stores reduced by seven during the year where the company believed high rental prices were not justified.

Vincent said the Group remains focused on delivering its core strategy.

“While we have demonstrated our ability to return to positive retail sales, consumer confidence is expected to remain soft and we continue to adjust our cost base accordingly to deliver profit growth,” Vincent said.

He expects performance during the year will initially be determined by the sales over the Christmas trading period and said the resolution of the 7th Community Pharmacy Agreement negotiations remain important.