By combining a shaggy rug offcut and a wire storage basket, Samantha Slater has fashioned herself a brand new ottoman.

Promptly, her 64,000 Instagram followers sound off in the comments. "So clever! I have to try this at home," writes one.

"Love this one, the easy hacks are always my favourite," enthuses another devoted fan.

Surprisingly, the two aren't talking about infiltrating computer systems. Instead, this is the world of Kmart hacks, where shoppers from across the country – largely mums and Millennials – share their creative stylings and DIY takes on products from the discount department store.

In the past five years, hundreds of similar Facebook groups and Instagram pages have sprung up across the internet, many with membership numbers that would rival some large country towns.

Some focus on the hacks, some review products, and others share design inspiration. But all have the same caveat: thou must love Kmart.

These swathes of devoted customers mark a significant change in fortune for the once-troubled Kmart, which less than 10 years ago was struggling to differentiate itself from its competitors, including its more profitable stablemate Target.

In 2010, the company's earnings were just under $200 million and parent company Wesfarmers was looking at ways to grow topline sales. It had embarked on a new 'Expect Change' campaign, desperately trying to convince shoppers the low-end retailer had changed its stripes.

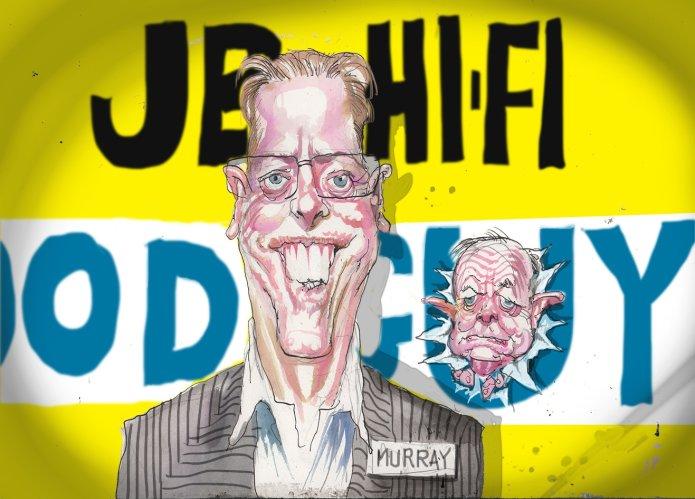

This was under the leadership of turnaround king Guy Russo, who eventually succeeded in flipping the script for the discount retailer, focusing on lowering prices, simplifying product ranges, and bringing in more on-trend pieces.

Within just four years Kmart's sales and earnings far outstripped Target's, and the department store has continued to shine even in recent years when weak confidence and low spending has seen other retailers suffer.

With Kmart's successful reinvention came a notable change in how the business sold itself to customers. Splashy catalogues with weekly specials were replaced with images of chic home settings, coupled with a greater focus on social media and TV advertising.

"If you think back a few years, in the discount department store space it was very catalogue-driven, almost all the communications were based on your catalogue," Laurie Lai, Kmart's general manager of marketing told The Sydney Morning Herald and The Age.

"We know our customers were moving on to digital, social media, watching online TV, all those things. So we went that way too."

The business also moved away from focusing just on low prices, pivoting instead towards "value" – giving customers the absolute best bang for their buck, rather than having them spend as few bucks as possible.

At the heart of this strategy are the products themselves. Walking through a Kmart store can feel like a scene from a Wes Anderson movie, with simple wood and pastel tones a dominating feature.

The eternal popularity of these ranges – some sell out within hours of launching – are a testament to the company's 50 person-plus buying and design team, who work with 9 to 12-month lead times to cook up the new products, often taking inspiration from international designers.

However, some local designers have accused the retail giant of poaching and reproducing their own designs, a claim the company rejects, saying instead it looks to global trends for its inspiration.

"We actually get the international trends that all retailers use, right off the catwalk," Julie Miller Sensini, Kmart's general manager of apparel and design says.

"And then we distil those down into what we know our customers like and dislike."

That's aided by collaboration with pages like Slater's (who is otherwise known as the Kmart Hack Queen). She says the Kmart team regularly take feedback from her and her followers, including flying her to special sneak-preview events of new ranges, and providing them with the occasional free product.

"They take our feedback and they're always looking at what questions we get, and what answers people give," she says. "I think they're just really grateful we're putting so much time in."

And while it might look to some like Kmart is pulling the strings behind these massive fan groups, Lai stresses they are entirely organic, but notes Kmart's team draws "a lot of inspiration" from the innovative fans.

The 'cool mum' of department stores

Intentionally or not, Kmart has succeeded in becoming the envy of every low-end department store in the country that has struggled to shake some of the 'cheap and nasty' stigma associated with the segment.

Jana Bowden, associate professor in marketing at Macquarie University, believes Kmart has succeeded over competitors like Target and Big W by eradicating that stigma, turning the potentially embarrassing experience of shopping at a discount retailer into something shoppers want to share.

"Instead of being embarrassed by the experience they take pride in going discount shopping, buying something on a tight budget, and showing other consumers how they've managed to succeed with that tight budget," she says.

"They've fostered a real pride in being thrifty."

But with the retail sector currently taking a beating, and fellow discounters Big W and Target shutting stores, Bowden questions if Kmart's fortunes can last.

"There are questions about the longevity of their strategy," she says. "Kmart is going to have to keep reinventing the wheel to make its campaign look innovative and keep drawing consumers in.

"That may have a limited lifespan if the economic conditions become more severe in the retail market."