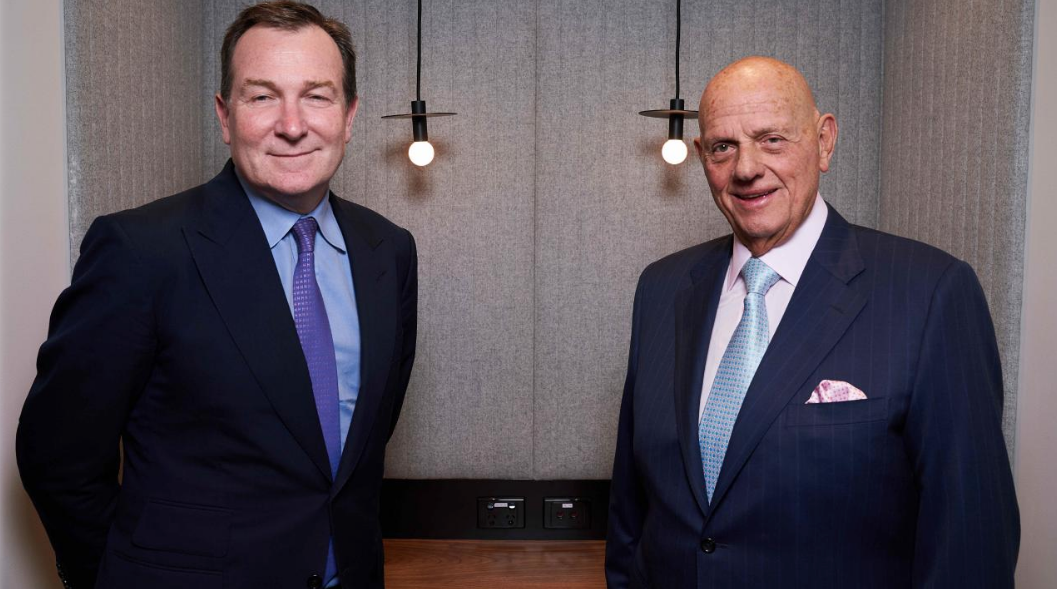

Retail veterans Solomon Lew and Mark McInnes have put to bed doubts about Premier Investments' strategic shift for its valuable Smiggle brand, flagging a surge in sales this year as Smiggle lunchboxes and pencil cases start selling in 180 more stores overseas.

Premier shares posted their strongest gains for more than 12 years, rising as much as 23 per cent to a 12-month high of $19.30 on Friday, after Mr Lew and Mr McInnes said Smiggle's "capital-light" global expansion plan, unveiled last September, was beating their expectations and was likely to be more profitable than the previous strategy of opening hundreds of standalone stores.

Premier is setting up Smiggle concessions in United Kingdom and European department stores such as Selfridges and Harrods, selling Smiggle products on websites such as Amazon in Europe, and selling a wholesale range to retailers in Canada, South Korea, Thailand, Indonesia, the Philippines and the United Arab Emirates.

While Smiggle sales rose only 4.6 per cent to $306.5 million in 2019, a fraction of the growth in past years, Premier said $17 million of recent wholesale orders from retail partners in these six countries would boost sales as much as 25 per cent in the first half of next year and there was scope to double the number of wholesale outlets from 180 to 350 in one to two years.

Smiggle sales in the first six weeks of the new financial year rose 5.2 per cent, up from 4.4 per cent in the July half, despite Brexit chaos in the UK and tough retail conditions in Australia.

Premier remains confident the new strategy will lift Smiggle sales to $450 million in calendar 2021 or calendar 2022.

"Smart investors really understand this wholesale business and the value that can be created," Mr McInnes told the Weekend AFR after unveiling a better-than-expected 11.5 per cent increase in underlying retail earnings to $167.3 million for the year ending July.

"They know the EBIT margin for wholesale sales is greater than the EBIT margin of [retail sales] ... we've kept the brand and [the retail partners] have taken all the distribution risk," he said.

"When you add that to a record Peter Alexander result and record apparel result and add the fact we've been negotiating well with landlords – it's all those things, not one," he said.

While most clothing retailers are struggling to maintain sales, Premier's clothing brands posted 7.8 per cent same-store sales growth, offsetting the effect of 35 store closures to lift retail sales by 7.5 per cent to $1.27 billion.

"[There's] a lot to like in this result with Peter Alexander, the core brands, and online sales outperforming," said Airlie Funds Management portfolio manager Matt Williams.

"Smiggle sales consolidated in Australia and the UK but growth from Asia was fantastic [and] management seem very excited about the Smiggle wholesale strategy, and if the longer term sales target is met then I think Premier will continue to be a very good investment," he said.

Mr McInnes said the results reflected better products, strong cost control and marketing rather than a recovery in consumer spending in Australia, where recent stimulus in the form of tax and interest rate cuts had yet to boost sales.

"Macro conditions are still quite difficult – it doesn't feel there's buoyancy," he said.

"But you'd have to say at some point in time people will stop saving and start spending – we haven't seen that yet but hopefully that will be a future tailwind for us."

One of Premier's strongest performers was Peter Alexander, where sales rose 13.3 per cent, bolstered by nine new stores and expanded plus-size and children's sleepwear ranges. The sleepwear chain plans to open between 20 and 30 stores in the next two years.

At 49-year-old denim chain Just Jeans, sales rose 13.7 per cent, despite a net two store closures, and Jay Jays sales were up 6.7 per cent even though a net three stores closed.

In women's fashion, Portmans' sales rose 3.5 per cent and Jacqui E's 3.3 per cent, but Dotti's sales slipped 0.1 per cent as a net six stores closed.

Credit Suisse analyst Grant Saligari said the Smiggle growth plan was well ahead of market expectations and Premier had managed to increase profits strongly without investing additional capital.

"You're getting growth without putting capital into the business – that's valuation accretive," he said.

Analysts also believe there is potential for Premier to cut rents in Australia and the UK, where Smiggle leases have break clauses enabling the retailer to renegotiate 10-year leases after five years. Premier booked $25.8 million in one-off costs to clear the way to break leases early on about 134 Smiggle stores.

Mr McInnes said Premier was loath to close profitable stores but, now that it had other options including online, concessions and wholesale, it would do so unless landlords came to the party.

"We just want landlords to offer us a level playing field," he said.

Online sales rose almost 32 per cent to $148 million after growing 65 per cent last year and further growth is expected this year. Premier is in talks with Alibaba to sell Smiggle products in China.

"Importantly, that opportunity isn’t included in our $450 million [Smiggle sales target], it’d be in addition to that," Mr McInnes said.

Premier's bottom-line net profit rose 27.7 per cent to $106.8 million, compared with $83.6 million in 2018, when the company wrote down the value of Just Jeans, Jay Jays and Dotti by $30 million.

The bottom-line result included a $18.9 million profit from Premier's 28 per cent stake in appliance maker Breville, which is worth $239 million on the books but has a market value of $692 million. Premier also owns a 10.8 per cent stake in Myer worth $48 million, half what it paid two years ago.

Premier increased its final dividend 12.1 per cent to 37¢, payable on November 15, taking the full-year payout to 70¢ a share compared with 62¢ in 2018.